The author is a CEO and Co-Founder in Eucloid. For any queries, reach out to us at: contact@eucloid.com

How Intelligent Data Processing is Disrupting Traditional Processes in the Insurance Industry

Picture this: The year is 2030, and manual document processing is a thing of the past. No more tedious hours spent extracting Enclosed Data, no more mistakes due to human error, and most importantly, no more wasting valuable time and resources. Thanks to the shift towards remote work caused by the global pandemic, more and more businesses are realizing the immense benefits of Intelligent Document Processing. In fact, by 2025, Garter has predicted that 50% of all business-to-business invoices worldwide will be processed and paid without any manual intervention. And that's not all. By 2030, this number is expected to rise to a staggering 80%.

However, the impact of this digital transformation goes far beyond just streamlining workflows and increasing efficiency. In industries like insurance, it is impacting the entire landscape — providing insights, improving risk assessment, and paving the way for a more customer-centric and data-driven approach.

Managing the Data Deluge: How insurance companies are handling huge chunks of data

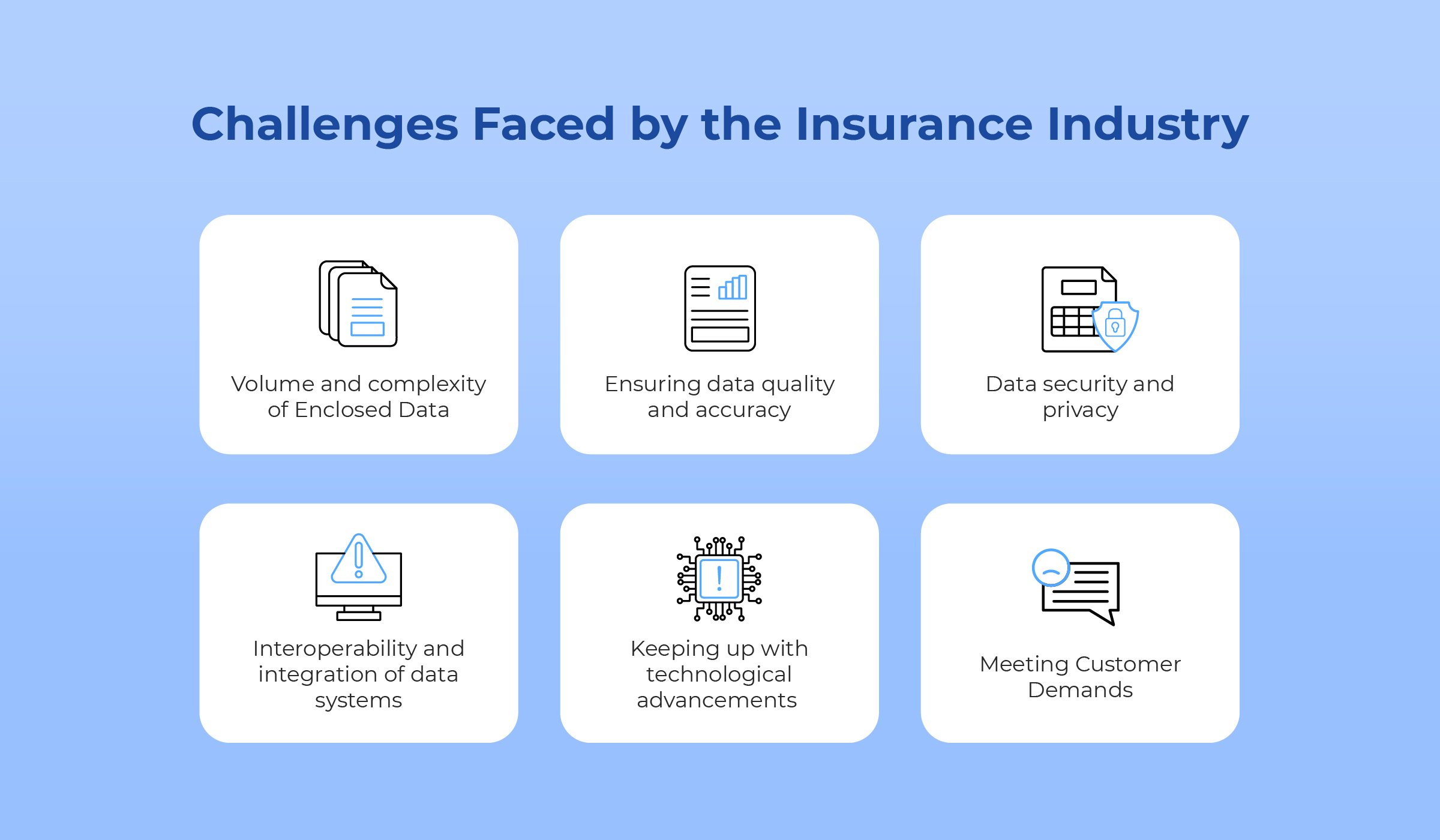

The insurance industry has been thriving on massive volumes of Enclosed Data, with every stage of the insurance process being heavily reliant on it. From handwritten documents to PDFs and images, the wide range of customer documents poses a significant challenge for accurately obtaining necessary data. With a mounting number of documents to process, the resources involved in this laborious task encounter difficulties in keeping up with the pace.

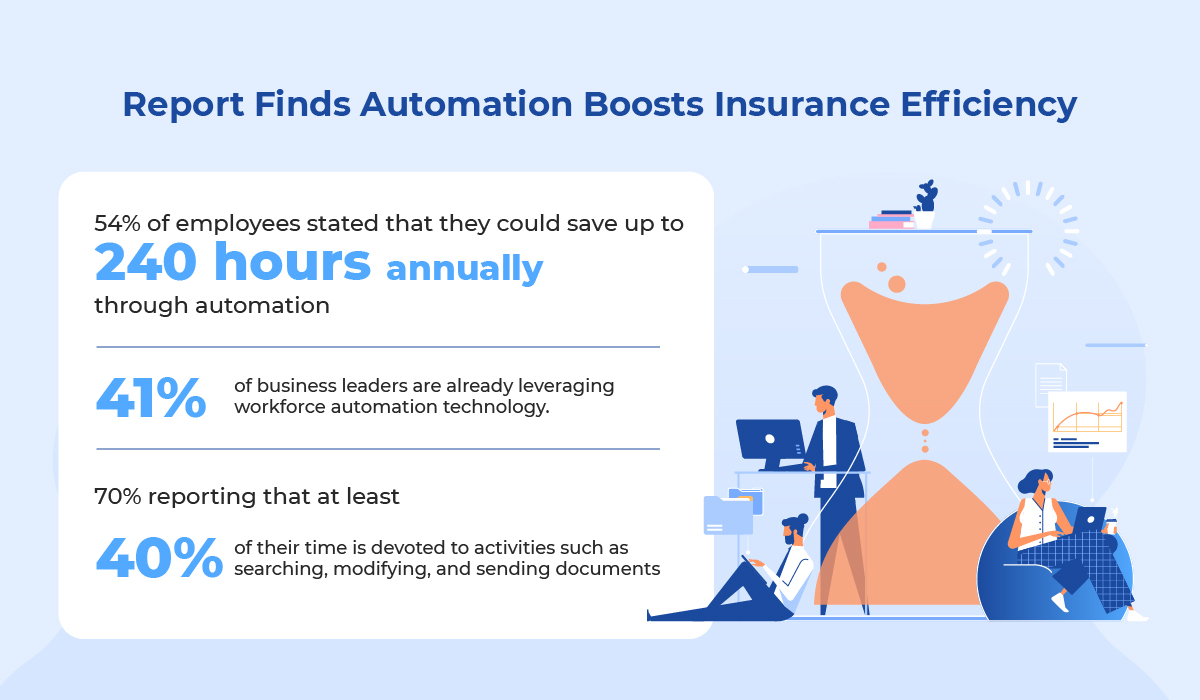

Recognizing these challenges, the 2020 In(Sight) Report by WorkMarket, in partnership with KRC Research, investigated the state of automation in four key industries - media and publishing, financial services and insurance, telecommunications and IT, and corporate retail. The study surveyed 200 business leaders and 200 employees, shedding light on workforce productivity, business impact, effective workforce management practices, the use of contract labor, and compliance, among many others.

The findings of the report revealed how employees and business leaders across industries think that automation could significantly enhance efficiency in the insurance industry.

This further amplifies the pressing need for insurance companies to streamline their operations and reduce dependence on manual processes for document-related tasks, emphasizing the value and impact of automation. With its potential to save time, improve accuracy, and enhance reliability, automation emerges as a vital solution for the insurance industry's struggle with navigating through colossal volumes of Enclosed Data within documents.

How Intelligent Document Processing (IDP) solves this problem

Intelligent Document Processing (IDP) plays a critical role in the modern business landscape where data is an asset. The plethora of insurance documents, each with its own structure and format, makes the process of data extraction a challenge. Managing policies, claims, declarations, loss runs, statement of value, and other documents can result in data silos and hinder efficient decision-making. Moreover, ensuring the security and privacy of sensitive client and policyholder information throughout the data extraction process is crucial.

Thus, insurance companies are increasingly turning to IDP solutions that employ artificial intelligence, machine learning and natural language processing to accurately identify various types of insurance documents and extract all the Enclosed Data. This helps serve a larger customer base within a limited timeframe.

.jpg)

For instance, Eucloid successfully processed a large dataset of 30 terabytes, comprising of 18 million insurance documents from multiple carriers with its IDP solution. The solution employed a multi-step approach that included organizing the data, utilizing custom keyword-based classification to identify carriers, implementing model-based classification for document types, enhancing traditional Optical Character Recognition (OCR) for accurate text extraction, and performing rigorous quality control measures to ensure data accuracy and compliance.

These IDP solutions are equipped to handle the diversity of insurance documents by converting multi-page PDFs into individual pages and classifying metadata into different insurance document types. Additionally, they prepare the files for data extraction and systematically extract data module by module, while ensuring the security and privacy of sensitive information. To further ensure accuracy, these solutions employ quality control measures, such as data validation and cleanup, to minimize errors and inconsistencies in the extracted data. This also helps in compliance with regulatory requirements.

How exactly does IDP function?

Powered by advanced deep-learning AI algorithms, IDP can accurately recognize and classify documents in over 190 languages, just like a human processor. This technology automates data extraction by utilizing cognitive AI to accurately identify and extract Enclosed Data from complex documents, providing valuable insights for insurance companies. It enables the digitization and organization of physical documents, presenting data in a user-friendly format for easy analysis and decision-making.

Use-cases of IDP for insurance companies

With the mammoth data and complex processes involved in the insurance industry, it's no wonder that the sector is undergoing a paradigm shift with the adoption of IDP. Here are some of the ways IDP is reshaping the insurance landscape:

Streamlined Policy Management

By seamlessly handling data entry, verification, and policy updates, insurers can focus on providing seamless customer service during policy renewals, endorsements, or cancellations.

Faster Product Development

IDP automates the extraction and analysis of relevant data from multiple sources, allowing insurers to develop tailored products that meet specific customer needs. Not only does this reduce time-to-market, but it also gives insurance companies a competitive advantage.

Automated Finance and Accounting

Receipts, invoices, and other financial documents are an essential part of the insurance sector. IDP automates the extraction and validation of financial data from documents, ensuring accuracy and efficiency in tasks such as accounts payable and receivable, expense management, and financial reporting.

Efficient Claims Processing

By streamlining the extraction, verification, and analysis of claim-related documents, IDP automates the entire process, saving insurers time and resources. Its ability to pull data from various sources such as claim forms, medical records, and police reports ensures accuracy and detects fraudulent activities. This results in faster processing and shorter claim cycle times.

Enhanced Customer Services

IDP can help streamline vital processes like client onboarding, KYC verification, and policy issuance through the automation of document-driven workflows. It speeds up application processing, minimizes manual mistakes, and enhances the overall customer journey. As a result, insurers can offer quicker turnaround times, personalized services, and improved document management for customers.

Improved Insurance Analytics

IDP helps insurance companies by automating the extraction and analysis of information from multiple documents. The insights gained from this process enable insurers to optimize pricing, identify risks, detect fraud, and improve business performance.

2023 is seeing a major transformation in the insurance industry, and a key driver of this change is Intelligent Document Processing. It is automating tasks and reducing administrative overheads, leading to faster policy issuance, enhanced customer experience and increased sales effectiveness. This accelerates the sales cycle, boosts revenue, and drives success in a rapidly evolving market.

The rise of IDP is not just a technological advancement, but a powerful force that is transforming the insurance industry into a data-driven future. It gives us the ability to navigate through the vast sea of information with precision and speed, unlocking insights from Enclosed Data that were once unimaginable. However, as the landscape of data processing continues to evolve, so must we. IDP may have been a pioneer in transforming the way we handle data, but we are now pushing the boundaries of innovation with our Document AI solution. Stay tuned to learn more about it!

Posted on : November 02, 2023

Category : Data Engineering

About the Authors

Raghvendra Kushwah

LinkedIn

LinkedIn